About the Offer

Over the last few years, EDP has been anticipating the trends in the energy sector and aligning its business model with the energy transition and the fight against climate change – a requirement for those who are committed to creating a more sustainable world for future generations.

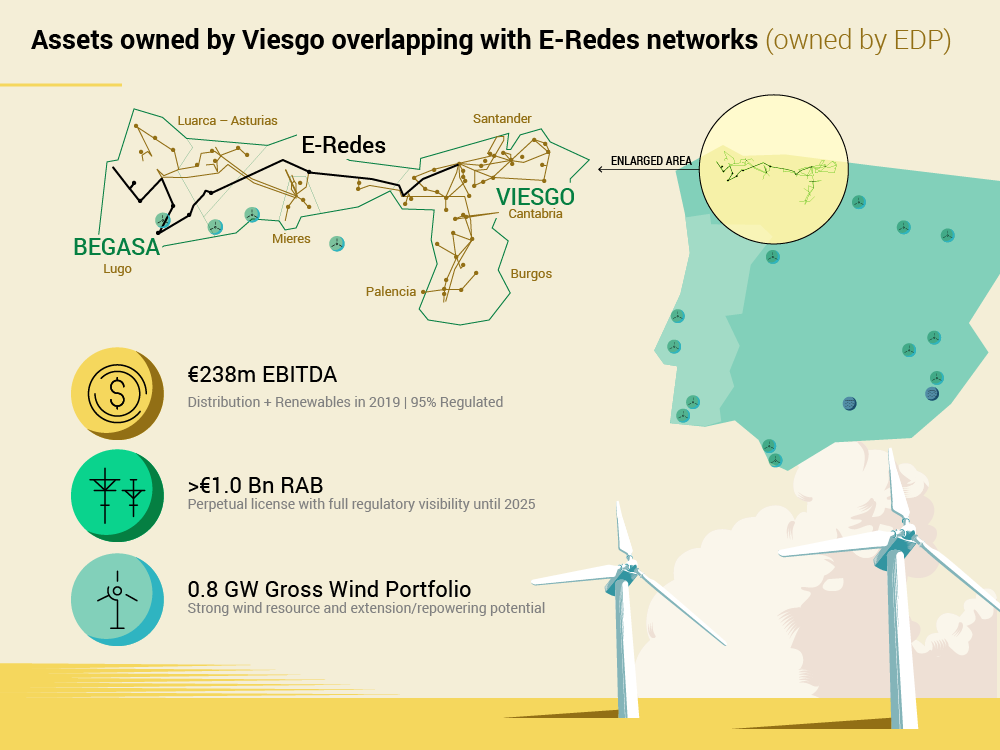

The acquisition of Viesgo allows EDP to take another significant step in reshaping its Iberian portfolio. Viesgo owns 31,300km of electricity distribution networks - adjacent to EDP Spain's electricity distribution networks, with a perpetual license and regulatory visibility until 2025 – and also 0.8GW of renewable assets and 0.9GW of potential interconnection rights (linked to thermal generation assets currently under decommissioning process until 2021) in Iberia.

EDP believes these assets will strengthen its low-risk business profile, which is even more relevant in a macroeconomic environment highly impacted by Covid-19, and will enhance its long-term growth prospects due to the high potential of electricity distribution networks in the context of the electrification of the economy.

The transaction is structured under a bilateral agreement with Macquarie, among others a long-term infrastructure asset manager. Macquarie will ultimately retain a 24.9% stake in the company which will own the electricity distribution business of Viesgo and EDP España. The remaining 75.1% stake will be held by EDP, which will consolidate the assets in its financial statements.

EDP’s focused and low risk growth ambition led EDP's Executive Board of Directors to opt for a rights offering to partially finance this transaction, with the aim of continuing the implementation of the deleveraging trajectory presented to the market in March 2019, which is critical for EDP to continue to play a key role in renewables and pursue sustainable growth in the context of the energy transition.

----------------------------

The information contained in this page is considered advertisement for the purposes of Portuguese law and it is the responsibility of EDP – Energias de Portugal, S.A.. Does not dispense the consultation of the prospectus approved by the Portuguese Securities Market Commission, available at cmvm.pt and here. The approval of the prospectus should not be understood as an endorsement of EDP – Energias de Portugal, S.A. or the securities subject to the Offer. The subscription of securities referred to on this page shall be made exclusively based upon the information contained in the prospectus. Potential investors shall read the prospectus before taking any investment decision in order to fully understand the potential risks and rewards associated with the decision to invest in the securities subject to the offer.

Registration of Share Capital Increase:

>> Registration of Share Capital Increase | consult

Offer Results:

>> Offer results | consult

Offer documents:

>> Offer Prospectus | consult

Other documents related to the Offer:

>> Viesgo acquisition announcement | consult

>> Roadshow presentation | consult

Webcast:

>> Access the webcast to watch the conference call | access

----------------------------

The information contained in this page is considered advertisement for the purposes of Portuguese law and it is the responsibility of EDP – Energias de Portugal, S.A.. Does not dispense the consultation of the prospectus approved by the Portuguese Securities Market Commission, available at cmvm.pt and here. The approval of the prospectus should not be understood as an endorsement of EDP – Energias de Portugal, S.A. or the securities subject to the Offer. The subscription of securities referred to on this page shall be made exclusively based upon the information contained in the prospectus. Potential investors shall read the prospectus before taking any investment decision in order to fully understand the potential risks and rewards associated with the decision to invest in the securities subject to the offer.

Frequently Asked Questions:

EDP is raising its share capital with the objective of being able to partially finance the acquisition of (i) 75.1% of Viesgo's distribution business, (ii) 100% of Viesgo’s renewable business and (iii) two coal thermal plants (which are under the process of decommissioning) without such acquisition having an impact on EDP’s expected credit/leverage metrics, which are essential for EDP to continue investing in renewable energies and in the energy transition.

The share capital increase is however not conditional on the completion of the aforementioned acquisition.

The main reasons to why invest in EDP are the following:

(i) Investing in EDP is investing in the energy transition, as EDP has been recognized by the Dow Jones sustainability indexes as one of the most sustainable companies globally1;

(ii) EDP’s investment plan foreseen for the 2019-2022 period seeks to lead the industry’s decarbonization, with a clear focus on renewable energies and on the reinforcement of the electricity distribution network’s capacity;

(iii) Energy player with increasingly global presence, operating in 19 countries and 4 continents, with Portugal, Spain, the USA and Brazil as EDP’s main markets;

(iv) Early mover on renewable energies and one of the leading global operators in the sector, with a strong track record in the past decade of EDP’s strong capacity to execute renewable projects2;

(v) Excellence in the operation of electricity networks in Portugal, Spain and Brazil3, being such assets strategic for EDP and characterized by a stable and long-term cash-flow generation;

(vi) Low risk profile on the back of EDP’s exposure to regulated and long-term contracted activities, which represented 79% of the group’s EBITDA in 20194;

(vii) Track record of delivering value for shareholders, based on an investment strategy focused on sustainable assets with predictable cash-flows, as well as on the pursued asset optimization.

______________________________

1 EDP Annual Report 2019, page 10 (Portuguese version)

2 EDP Strategic Update 19-22, March 2019, pages 15 and 16

3 EDP Distribuição Annual Report 2018, pages 77 to 80; Memoria Justificativa de la Propuesta de Circular de la CNMC por la que se Establece la Metodología para el Cálculo de la Retribución de la Actividad de Distribución de Energía Eléctrica, page 36; Apresentação Institucional EDP Brasil, February 2020, pages 8 to 12

4 EDP Annual Report 2019, page 44 (Portuguese version)

In the Strategic Update announced in March 2019, EDP reiterated its dividend policy, comprising a dividend floor of EUR 0.19 per share. EDP has the objective of distributing dividends corresponding to 75% to 85% of its recurring Net Profit.

If the offer is fully subscribed (all 309,143,297 shares), the share capital increase of EDP will amount to 1,020,172,880.10€.

The subscription price is 3.30€ per each new share.

The share capital increase will amount to 1,020,172,880.10 €, through the issuance of 309,143,297 ordinary, book-entry and nominative shares, with a nominal value of 1€ each. These shares will be offered, through a public offer, for subscription to shareholders in the exercise of their subscription rights at the subscription price of 3.30€ per share.

A subscription right will be granted to each share not held by EDP (treasury shares). The ordinary shares that trade on Euronext Lisbon on or after July 21 2020, including, will no longer grant the right to participate in the offer.

The number of shares to be subscribed pursuant to the exercise of such rights is a result of the application of factor 0.085035375 to the number of subscription rights held at the moment of subscription, rounded down to the nearest whole ordinary share.

The shares that are not initially subscribed for are to be allotted to holders of subscription rights that have expressed an intention to subscribe for shares in addition to the number of shares that they are proportionally entitled to pursuant to their pre-emptive rights, pro rata to their number of exercised rights, rounded down to the nearest whole ordinary share. Requests for additional subscriptions shall be made together with the initial subscription request and are not separable thereof.

EDP signed with some financial institutions, including J.P. Morgan, Millennium bcp and Morgan Stanley (as “Joint Global Coordinators”) and BNP Paribas, BofA Securities Europe SA and Goldman Sachs International (together with the Joint Global Coordinators, the “Underwriters”) an Underwriting Agreement, subject to English law, under which such institutions committed to subscribe, subject to certain conditions, on their own behalf or on behalf of other institutional investors, all the shares eventually not subscribed.

The subscription period will run from 8:30 on July 23, 2020 to 15:00 on August 6, 2020 and subscription orders may be amended or revoked until, and including, August 5, 2020.

Rights trading period in the Euronext Lisbon runs from July 23 to August 3, 2020.

Subscription Rights that are not exercised or disposed of until the end of the subscription period will expire and no consideration will be due to the holders of the same.

EDP’s shareholders through the exercise of pre-emptive subscription rights. Each EDP share purchased until, and including, July, 20 2020, will be entitled to one subscription right. Subscription rights will trade on Euronext Lisbon between July 23 and August 3, 2020, including, allowing investors who envisage to purchase additional subscription rights, notwithstanding the possibility of transfer outside of the regulated market, as generally permitted by law.

Other investors (non-shareholders) through the purchase of subscription rights on Euronext Lisbon between July 23 and August 3, 2020, including, notwithstanding the possibility of transfer outside of the regulated market, as generally permitted by law.

All investors taking part of the offer, are entitled subscribe for shares in addition to that which they are proportionally entitled to pursuant to their subscription rights, pro rata to the value of their subscriptions, rounded down to the nearest whole ordinary share.

The subscription period will run from 8:30 on July 23, 2020 to 15:00 on August 6, 2020 and subscription orders may be amended or revoked until, and including, August 5, 2020.

The transaction of subscription rights and transmission of subscription orders should be submitted to the financial intermediaries legally entitled to provide the securities registration service.

The number of Shares that each investor may subscribe for is the result of applying the factor 0.085035375 to the number of rights exercised, rounded down. The subscription price for each share is 3.30€.

Moreover, each investor exercising their rights may apply for any remaining shares which will be distributed subject to a pro rata allocation. The number of such shares to be allotted cannot be determined in advance as it will depend on the number of remaining offered shares (those that result from subscription rights that have not been exercised by their respective holders) and on the investors that apply for such shares.

Yes, if you purchase subscription rights during the subscription trading period, in Euronext Lisbon, from July 23 to August 3, 2020, in an amount that allows the subscription of new shares, without prejudice to the possibility of transfer outside of the regulated market, as generally permitted by law. For example, in order to subscribe 1,000 new shares, you will need to purchase 11,760 subscription rights.

You may sell the subscription rights that you will hold and will not exercise, or you can purchase the additional subscription rights necessary to subscribe for the number of shares you want.

You shall request the financial intermediary receiving your order are to provide you with this information.

Fees or other charges payable by investors to financial intermediaries may apply on top of the subscription price (either on the exercise of rights, additional requests or trading of rights). These fees and charges may be found on the CMVM website at www.cmvm.pt and should also be provided by the financial institution receiving subscription orders.

The shares issued in the rights offer will be fungible with the other shares of the Issuer and will give their holders the same rights as all other shares of the Issuer existing before the offer and will be subject to the same tax regime.

Only investors who have exercised their subscription rights and have requested, in that moment, an additional subscription will be entitled to any remaining shares which will be allotted pro rata of their respective exercise of rights.

The offer results are expected to be disclosed on August 7, 2020 and will be available on cmvm.pt and here. In any event, only the result of the pro rata allocation of the remaining shares is uncertain until such date. The exact number of shares to be subscribed for through the exercise of rights is the result of applying the factor 0.085035375 to the number of rights exercised, rounded down.

Financial settlement is expected to occur on the first trading day after the end of the offer period, i.e., August 7, 2020, with respect to shares subscribed for upon the exercise of subscription rights and on the third trading day after the end of the offer period, i.e., August 11, 2020, with respect to those shares subscribed for upon the exercise of additional subscriptions.

The admission to trading on the Euronext Lisbon regulated market of the newly offered shares is expected to occur as soon as possible after the capital increase is recorded in the commercial register, i.e. on or about August 17, 2020.

The main offer dates are as follows:

- Last trading day of the Issuer’s shares on Euronext Lisbon, with Subscription Rights: July 20, 2020

- Rights trading period on Euronext Lisbon: July 23, 2020 to August 3, 2020

- Subscription period: July 23, 2020 to August 6, 2020

- Last possible date subscription orders may be revoked: August 5, 2020

- Settlement dates:

- For shares subscribed for upon the exercise of rights: August 7, 2020

- For shares subscribed for upon the request for additional subscriptions: August 11, 2020

- Shares start trading on Euronext: August 17, 2020

Please see Chapter 17 of the Prospectus.

----------------------------