A key element of EDP's strategy is to maintain a strong financial profile while delivering growth under remuneration regimes that provide visibility on the medium term cash flow generation power. EDP's financial discipline follows hand-in-hand with a strict financial criteria underlying investment decisions, timely execution of projects and a risk-controlled growth strategy.

At EDP, we keep a prudent financial policy to support our strategy.

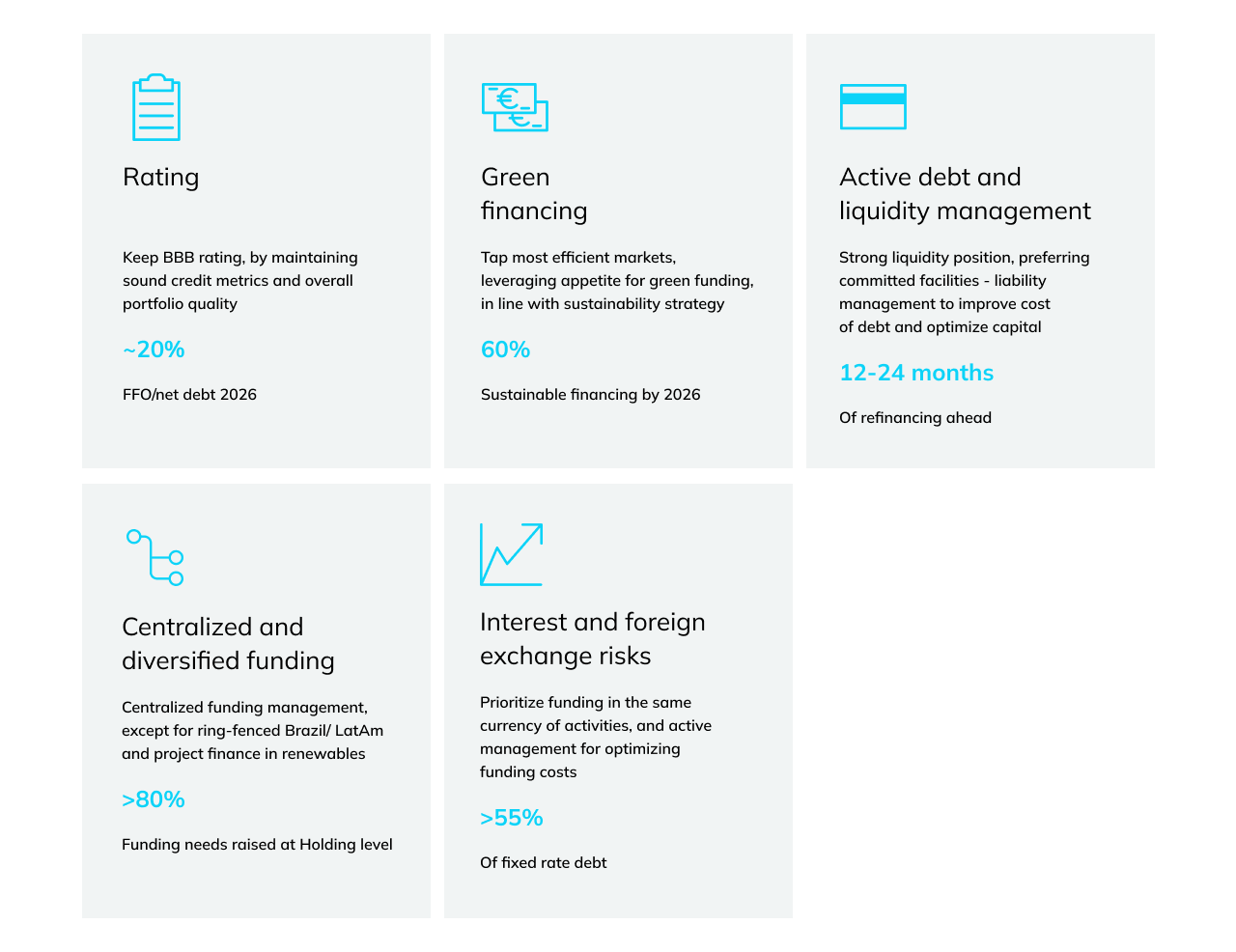

EDP’s financial debt is essentially raised at the level of EDP S.A. and EDP Finance B.V. and then on-lent to its subsidiaries. Our centralized financial management promotes efficiency and enhances costs savings. EDP raises funding through both international debt capital markets and bank loans. The funding that is raised at subsidiarity level is mostly project finance related, at EDP Renováveis level, and the result of our ring-fenced policy for EDP Brasil, which raises its funding needs locally.

We have a strong liquidity position backed by highly diversified sources which reinforces our low-risk profile. We favor committed facilities at competitive cost over cash and maintain at least 12 to 24 months of refinancing needs ahead. We diversify our sources of funds, tapping the most efficient markets and maintaining a wide range of strong financial counterparties. We also pursue an active management of foreign exchange risk, while maintaining a net investment hedge policy by raising funds in the same currency of our investments.

We target reinforcing our credit metrics in the period 2019-2022 as an additional lever to improve our financial risk profile.

In particular, we aim to reduce our Net debt/EBITDA ratio to <3.0x by 2022, backed by strong organic cash flow and capital reallocation towards reinforced low-risk business profile. We believe these credit metrics are consistent with our target for a BBB rating in 2019-22 period.

Green funding is an important tool to finance the energy transition, which assumes a particular relevance for EDP given our growth plan is mostly based on renewables, as such EDP established a Green Bond Framework to align both our sustainability and financial strategies.