Suppliers and producers buy and sell energy on the Iberian market all the time.

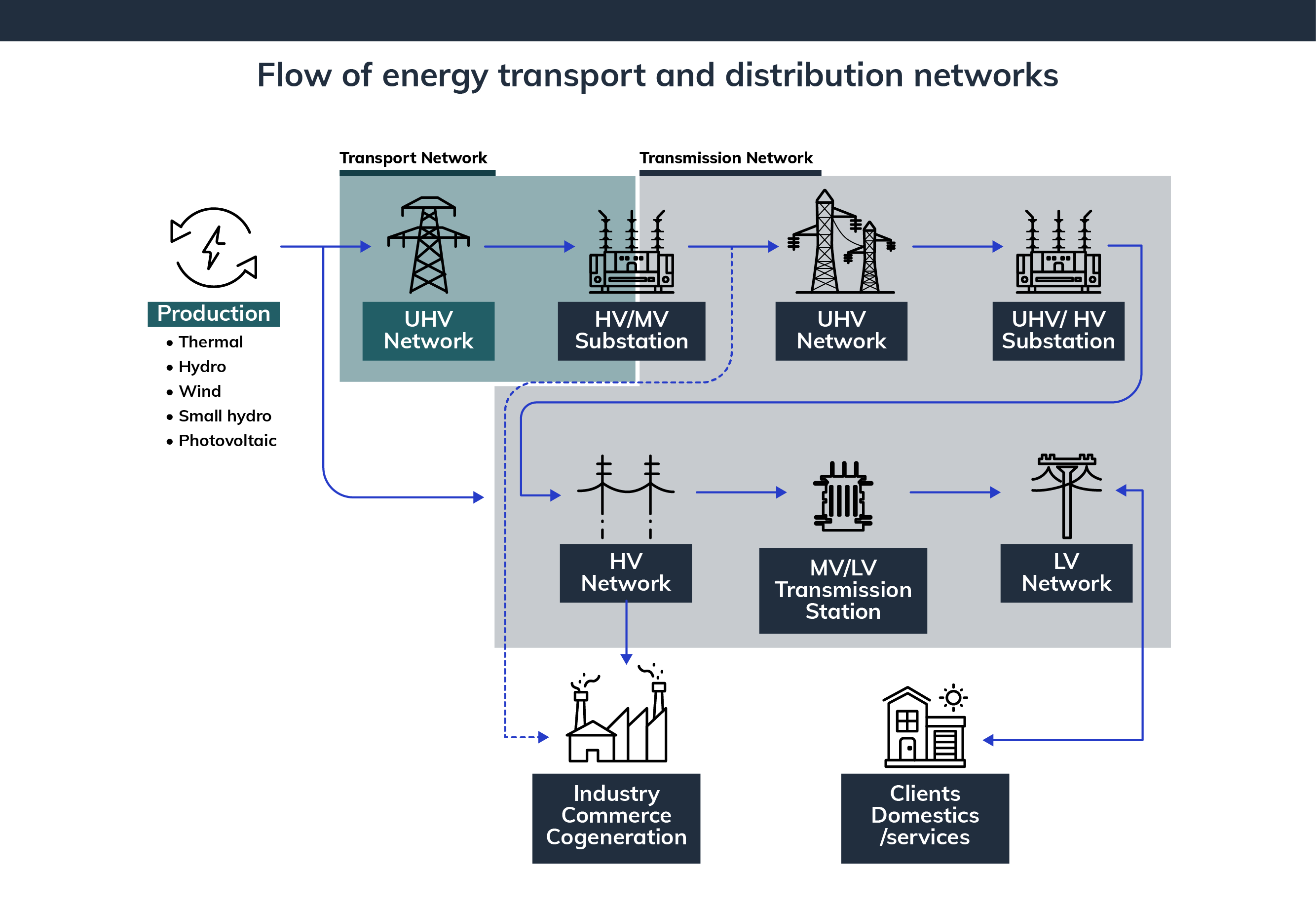

When we flick a switch or plug in an electrical device, we don't think about where the electricity comes from: it just exists. But the truth is that energy goes through a long (but very fast) transformation process until it reaches us.

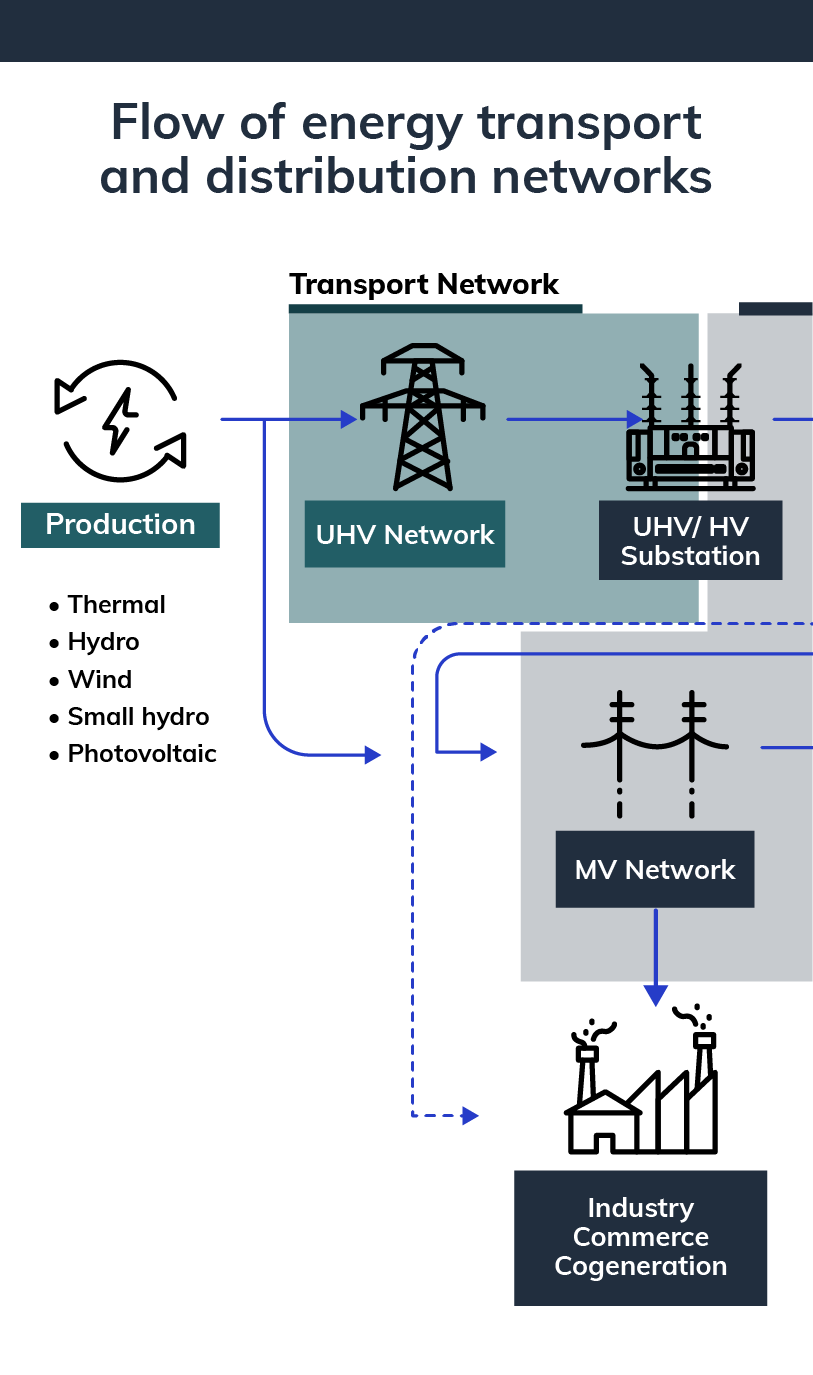

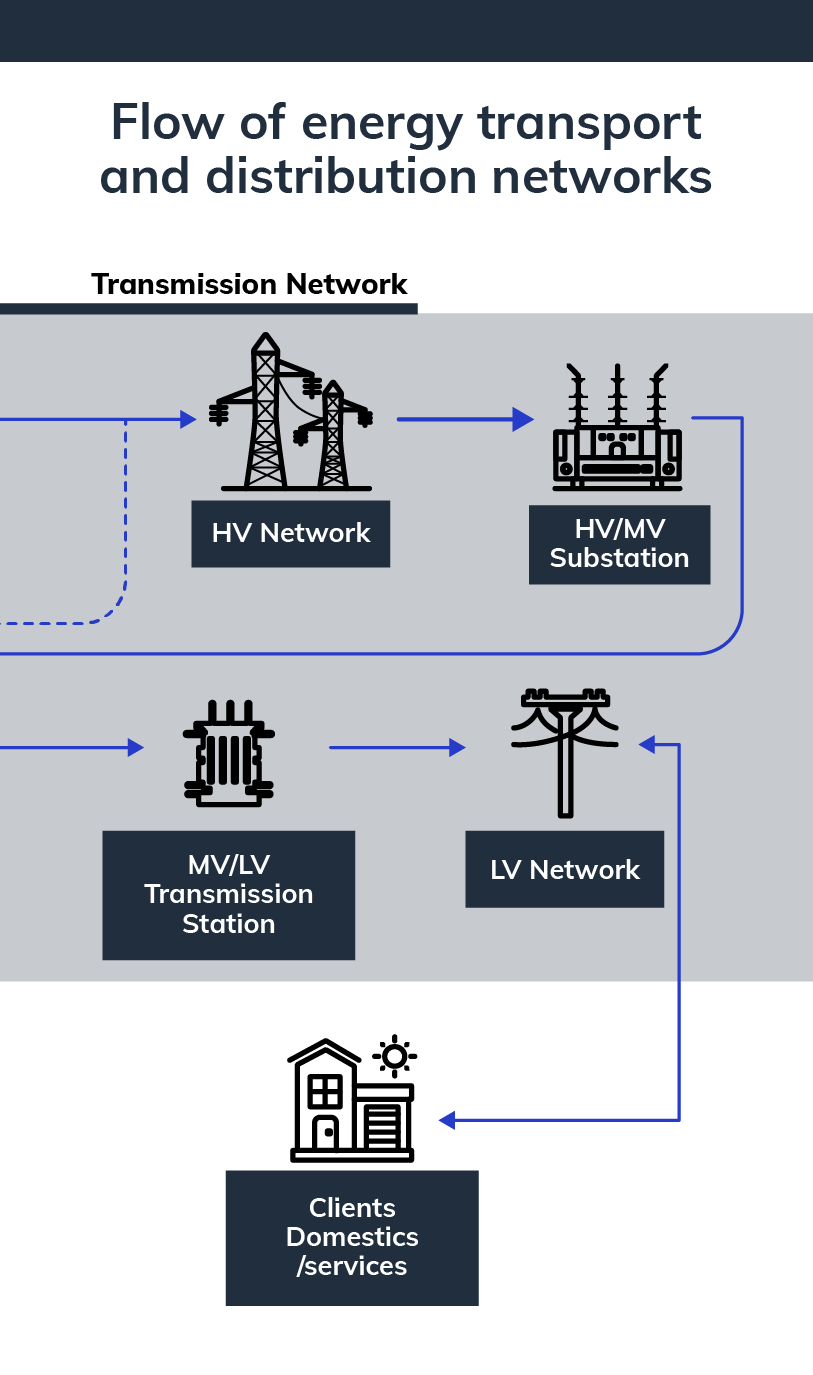

It all begins in the power stations that produce the energy. This is then transmitted to the (Very High Voltage) transmission networks, which passes it to the distribution grids (High, Medium and Low Voltage).

But let us go back a little further in this chain until the beginning of the energy production process. Like many other goods and products, electricity is also traded on markets. In the case of Portugal and Spain (which operate as one), this market is called MIBEL: Iberian Electricity Market. This is where virtually all producers and suppliers in the two countries buy and sell energy.

MIBEL was set up on 1 July 2007 to integrate the electrical systems in Portugal and Spain, bringing more benefits to consumers in both countries. MIBEL represented a physical, economic, legal and regulatory convergence of the two markets and allowed Iberian consumers to purchase energy from any producer acting in Portugal or Spain, and had the option of contracting with a supplier under free competition. In addition, MIBEL also ensures that all actors have the same conditions of equal treatment, transparency and objectivity in market access.

Energy prices vary every hour

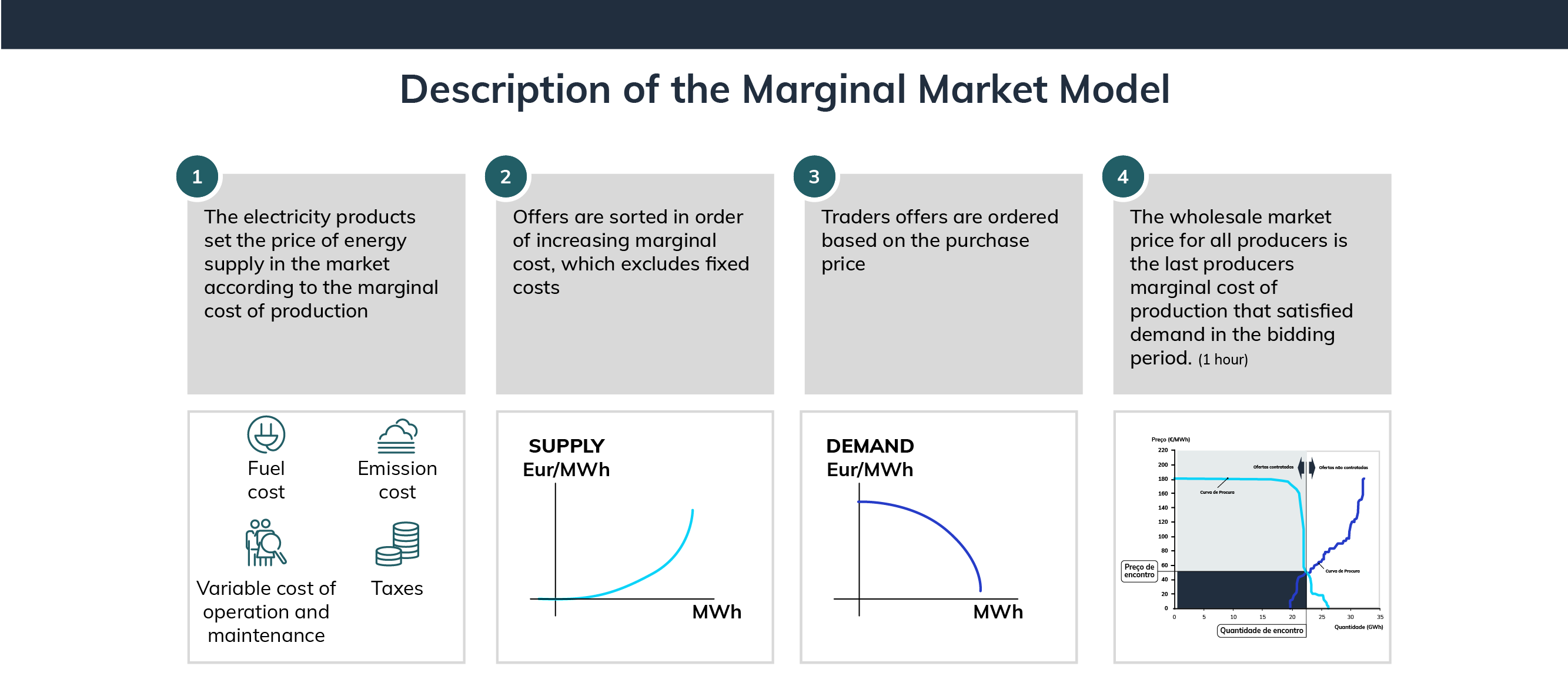

In the Iberian Peninsula, energy is mainly sold on the daily market, which aims to carry out electricity transactions by submitting bids and sales by all market players for 24 hours the following day. Every day at noon, energy prices and sources are set for the next day.

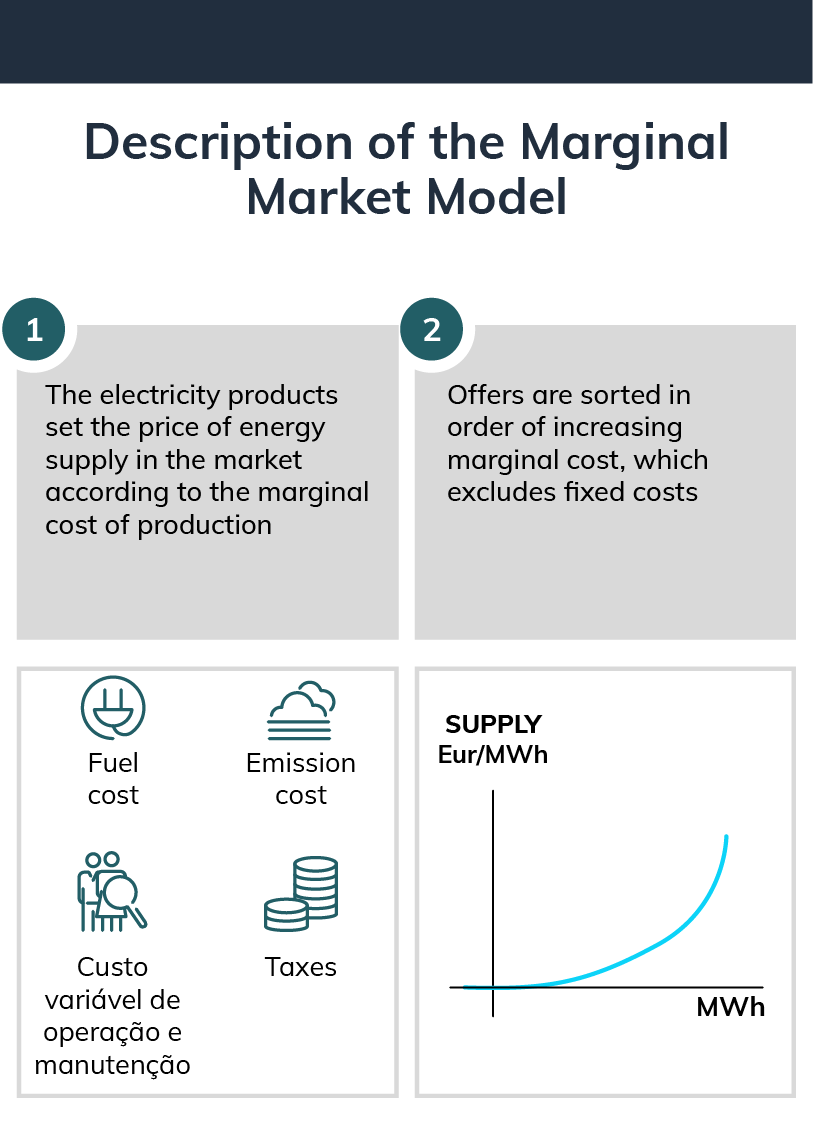

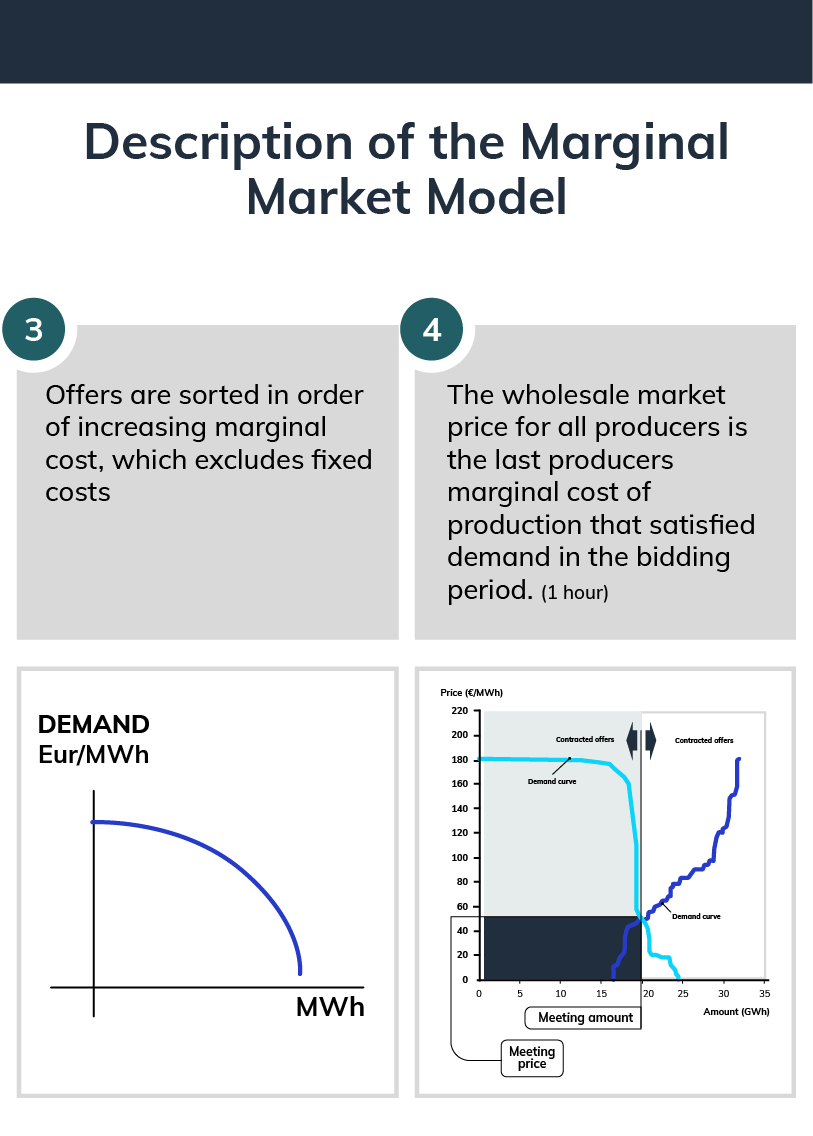

In the case of MIBEL (and all European markets), the marginal model is followed, where electricity producers make offers based on the marginal cost of production (which includes fuel cost, emission cost, variable operating and maintenance cost and taxes). Then all these offerings are ranked in ascending order. As for the suppliers' bids for energy purchase, they are ranked based on the purchase price, in descending order. The energy production price for all producers will be the point of interception between supply and demand, i.e. the marginal cost of production of the last producer meeting demand in the bidding period.

The integration of the Iberian market has brought benefits to consumers

You've certainly heard the expression "go to Spain to buy energy". However, it is an incorrect expression. The fact is that, since there is a single Iberian market, the production and supply of electricity between the two countries flows naturally. In the case of production, for example, the wholesale price is equal to around 95% of the hours, which makes it possible to produce energy more efficiently, using the power stations - in Portugal or Spain - which have the lowest marginal cost at any one time.

This is why you may sometimes find energy sources that do not exist in Portugal but do exist in Spain on your electricity bill (such as coal, whose last power station in Portugal closed in 2021, or nuclear energy).

A decarbonised electricity generation mix requires rethinking the current market design

Renewables have marginal costs of practically zero: for each additional MWh of energy produced from wind or sun, these costs are almost non-existent, as these are renewable and inexhaustible sources. In the case of hydroelectric plants with reservoirs, the rationale is different because there is an opportunity cost of water.

A marginalist market model (as described above) has a sharp increase in renewable electricity production that will bring the price down. Let's consider the following scenario: energy producers place enough wind and solar farms on the market to meet demand. What will happen is that the wholesale price of energy will tend towards zero, and therefore the initial investments of producers in these energy sources (which are primarily fixed costs and include, for example, the development of technology and the construction of parks) will never be paid back.

This is why decarbonising the electricity sector, which aims to achieve carbon neutrality before 2050, will require a redesign of the current market model to attract the necessary investments at a competitive cost.

EDP has a portfolio of 75% renewable energy distributed across the 20 countries where it is present and has made the commitment to reach 100% by 2030.

Auctions help mitigate investment risks

One way governments have found to encourage producers to invest in renewable energy is through auctions. The aim is to ensure that the energy price remains stable for at least most of the time the project is active, as this reduction in risk will attract more participants to the auction (thus increasing competition) and ensure the funding of these projects.

In Portugal, for instance, two solar capacity auctions have been held - one in 2019 and another in 2020 - both of which broke the world record for the minimum price of solar power. Investment in mature renewables will ensure great benefits to consumers in the long term. They see significant savings on their electricity bills and because they contribute to a cleaner environment and the national economy by avoiding fossil fuel imports.

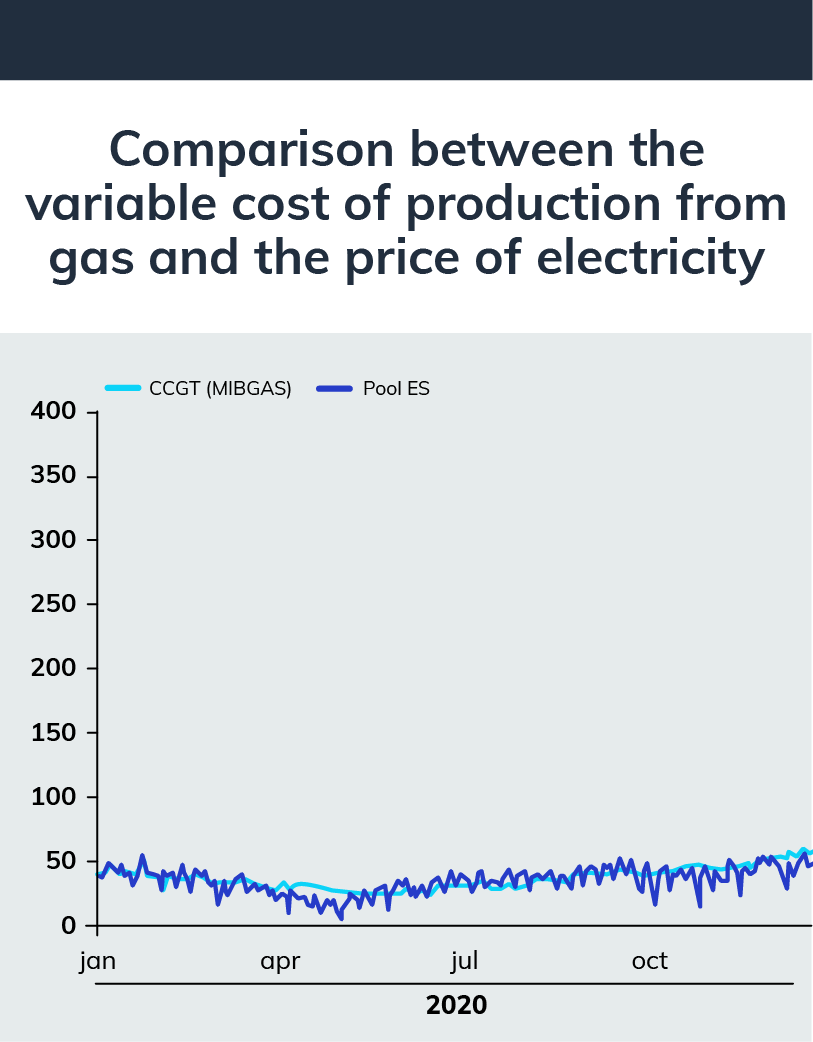

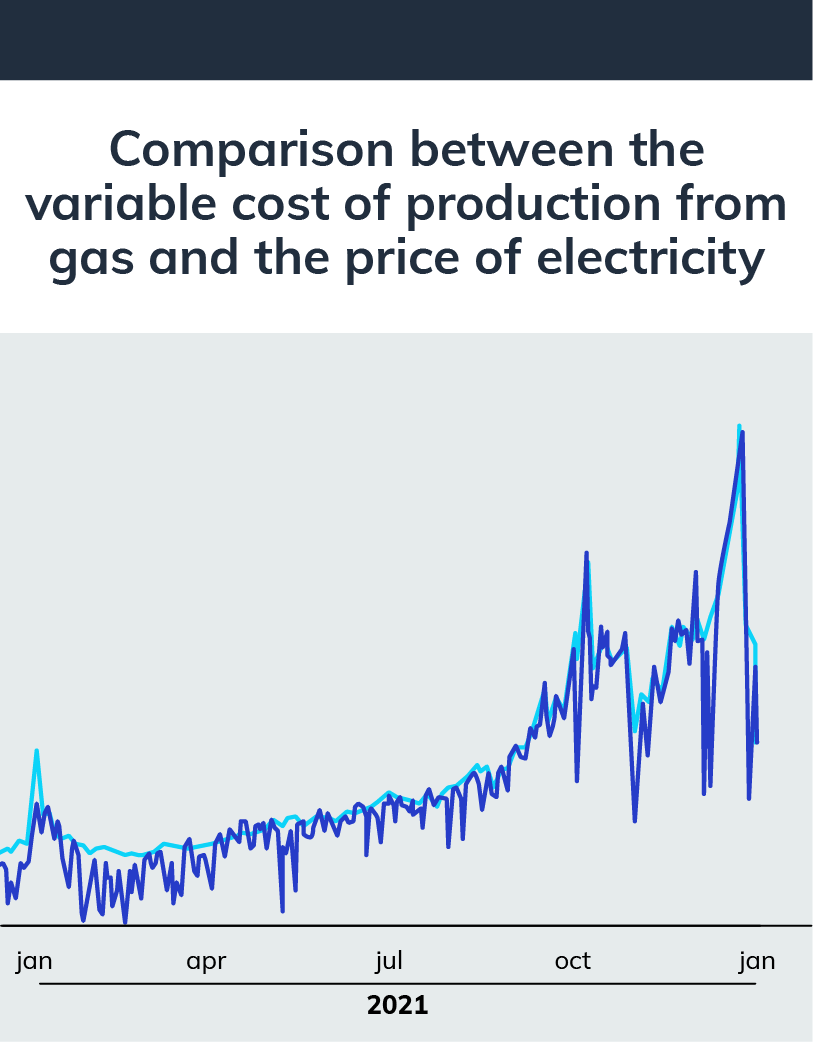

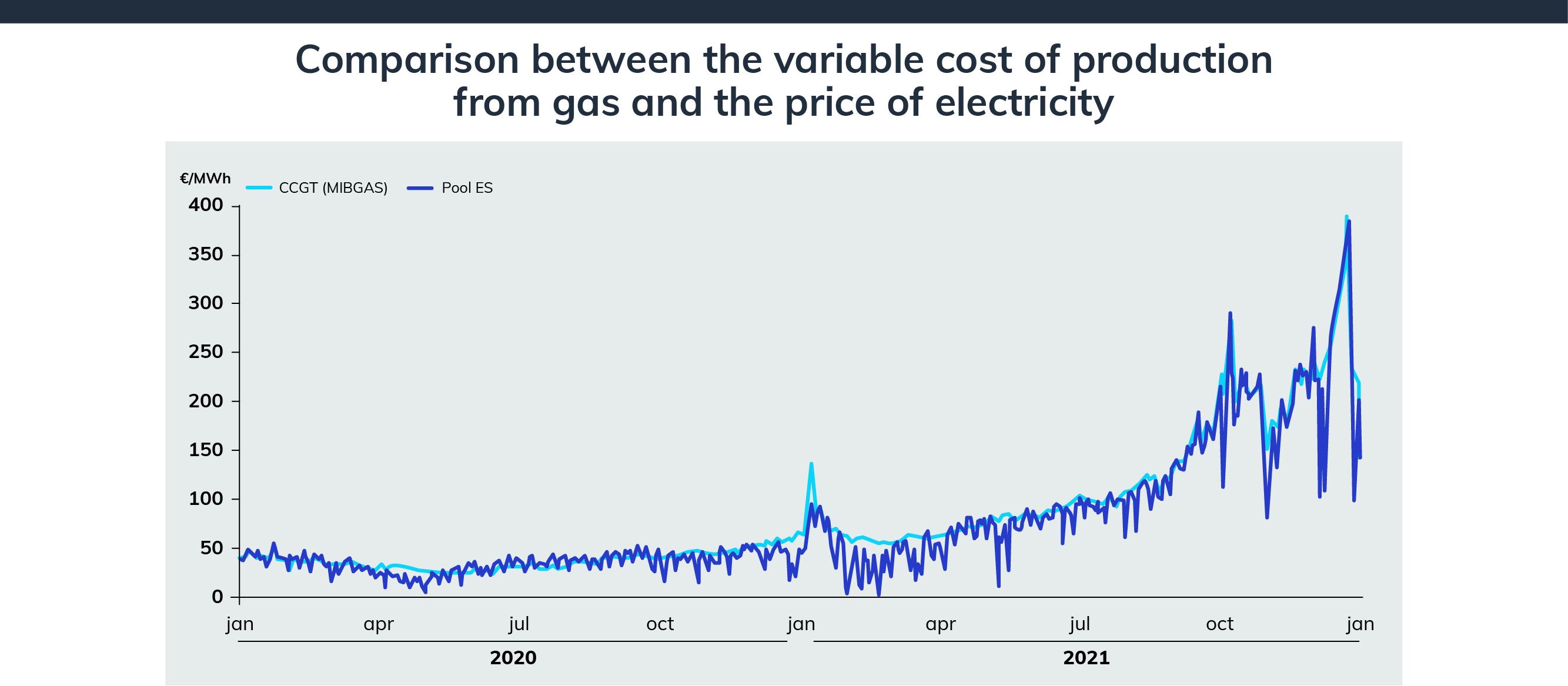

Rising fossil fuel prices push up energy prices

Several factors affect the rise or fall of electricity prices. These include rising fossil fuel prices or rising CO₂ prices, two of the main causes for rising wholesale prices. For example, in late 2021, the gas price was at historic highs, which caused the prices at which electricity is traded on the MIBEL (as well as on all European markets) to skyrocket. The phasing out of nuclear power, a drop in renewable production (e.g. due to lower hydroelectricity), an increase in demand and tax hikes on producers cause prices to rise.

In the opposite direction, the growth in renewable energy sources, the increase in decentralised generation (production of renewable energy for self-consumption) and the increase in energy efficiency contribute to lower MIBEL prices. These price rises and falls are not immediately reflected in the electricity bills of most consumers because suppliers adopt hedging strategies, buying energy in advance for an extended period.

What about Brazil?

Brazil is another market where EDP operates. However, the Brazilian energy market operates quite differently from the European one. Most electricity In Brazil is traded in long-term auctions (e.g. 15 years), making for greater price stability and predictability for producers. There is the difference market in the short term, where producers can buy the energy they need when they cannot produce. Unlike MIBEL, through which practically all energy traded passes, little energy is traded on this difference market, which translates into greater price volatility.