Learn about our action plan

In early March, EDP presented its strategic plan for 2023–26 to the markets in London, announcing a significant increase in its investment in renewable energy sources: €25 billion gross and 4.5 GW of gross additions per year. This strategy aims to accelerate the company’s long-term sustainable growth and guarantee its commitment to the energy transition.

How does EDP plan to meet its all-green environmental targets by 2030?

The company has reiterated its commitment to abandon coal-fired generation by 2025 and reach 100% renewable generation by 2030. The goal is to achieve net zero emissions by 2040, as approved by the Science Based Targets initiative (SBTi).

To achieve this target, EDP is stepping up renewable capacity growth to about 4.5 GW per year, adding about 18 GW of new capacity by 2026. The objective is to have about 33 GW of renewable installed capacity by 2026, aiming to exceed 50 GW by 2030.

How will the overall investment of 25 billion be distributed?

This gross investment of €25 billion for the 2023–26 period includes around €21 billion (85%) in renewable energy sources and around €4 billion (15%) in distribution grids. It represents an average annual investment of approximately €6.2 billion, 30% higher than the target set in the previous business plan.

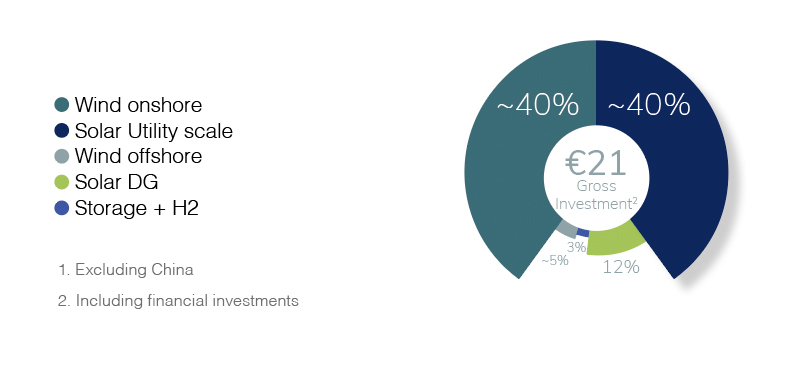

The goal of diversifying the portfolio by investing in different renewable technologies remains unchanged: onshore wind (40%), utility-scale solar (40%), solar distributed generation (12%), offshore wind (5%), and batteries + hydrogen (3%).

Offshore wind, through the Ocean Winds joint venture, will represent 5% of the total investment in renewable energy sources — a figure which is expected to rise over the next 10 to 15 years. A diversified technological mix of renewable energy is supported and bolstered by a hydropower portfolio with strong cash flow generation, simultaneously providing flexibility and storage capacity.

Wind & solar

Wind onshore (5.0 GW) - Top 4 global1 player with extensive track record along the full value chain with highly experienced teams

Wind offshore (0.7 GW net) (1.9 GW in gross additions) - Significant growth opportunity with medium term value crystallization, and CAPEX acceleration post 2025.

Solar Utility scale (9.4 GW) - Additions ramping up quickly, leveraging presence in growing markets, through traditional and new technologies (e.g., floating solar).

Solar Utility scale (2.1 GW) - High growth market, leveraging on developed capabilities and portfolio, global footprint with transversal segments and business models, and synergies with utility scale.

Storage (0.5 GW) + H2 - Market starting to materialize by 2025; target mainly co-located opportunities.

Growth avenue reinforced by recent targets and existing portfolio; equivalent to ~0.4 GW of gross additions in partnership structures (incl. JVs)

How will the investment be spread across the different countries where EDP Group operates?

Europe and North America will split 80% of the investment, with each region getting 40% of the total. The other 20% will go to South America (15%) and Asia–Pacific (5%).

EDP currently has 22.4 GW of renewable installed capacity: 11.3 GW in Europe, 7.2 GW in North America, 3.1 GW in South America, and 0.7 GW in the APAC region. The company generated a total of 45 TWh last year.

How important will the distribution grid segment be?

The distribution grid segment will account for €4 billion of the investment plan. EDP will expand and diversify its portfolio in an area that will continue to represent a factor of stability for the company’s business. The strategic plan also foresees expanding the distribution grid to include 400,000 kilometers, 9 million smart meters (2.5 million more than in 2022), and 12 million connection points (500,000 more than in 2022).

Distribution business

What role will innovation and digitalization play in the coming years?

Innovation and digitalization remain at the heart of the strategy, driving change and accelerating the energy transition with a bolstered investment of €3 billion by 2026 (€2 billion for digitalization and €1 billion for innovation).

With regard to digitalization, EDP wants to reinforce the “digital first” mentality and culture, driving opportunities and increasing agility in the company. The goal is to reach 2026 with advanced analytics in 85% of our energy assets, artificial intelligence in 100% of our businesses, and 95% of our processes digitalized.

As far as innovation is concerned, the company intends to develop and scale internally incubated projects, build closer relationships with stakeholders — by running open innovation pilot projects, for example — and continue to invest in high-potential strategic startups. The macro objectives are the rapid adoption of innovation to accelerate the impact of what is new and the engagement of our people on a global scale in strengthening the predictive capacity and business expertise of the EDP Group.

Why did EDP launch a 100% tender offer over its listed subsidiary EDP Brasil?

According to EDP, the aim of this operation is to simplify the corporate structure and increase value with the company’s delisting. Brazil is a substantial market with robust fundamentals and numerous opportunities in energy transition. The reshaping of its portfolio in the country will enable EDP to continue to invest and strengthen its focus on the renewable energy and distribution grid segments, while reducing exposure to hydropower and moving away from thermoelectric generation.

Since 1995, EDP Brasil has grown with two additional power distribution concessions with 3.8 million customers, more than 2,000 kilometers of transmission lines, and 2 GW of hydropower capacity. EDP Renewables Brasil, which was established in 2009, currently boasts 1.1 GW of operational and under construction renewable capacity.

How will this operation be financed?

The tender offer will be financed by a €1 billion raise in equity capital from institutional investors, which will provide greater flexibility to manage EDP Group’s integrated presence in the Brazilian market.

As was disclosed to the market on March 3, 2023, EDP has already concluded this capital increase. The delisting of EDP Brasil is expected to be completed by the third quarter of 2023.

What is the new dividend policy?

The company has implemented a new dividend policy with a payout ratio of 60–70% and an increase of the minimum dividend to €0.20 per share in 2026. This plan represents, according to EDP, a clear commitment to the energy transition; it accelerates investment and sustainable growth with a leaner, more global organization to create value for our stakeholders.

What are some of the EDP Group’s targets in terms of ESG?

The strategic plan calls for more than 3,000 new hires by 2026 bringing a net total of 14,000 employees. It also sets a target of 31% women in senior positions, grounding the company’s talent management strategy on recruitment, experience, and development, as well as maintaining its position as a top employer in all the markets where it operates.

EDP currently employs people from 64 different nationalities from around the world, and they will continue to support the EDP Group’s ambitious objectives with their own drive and diversity.

EDP will also continue to support communities, helping them play an active role in the energy transition. This commitment will run in parallel with the effort to protect the planet for future generations, engaging our partners in a decisive transformation. With this objective, EDP Group expects to invest up to €200 million in social impact initiatives between 2021 and 2026.

Why are solutions such as hybridization, repowering, storage, and hydrogen playing increasingly important roles in the EDP Group’s business?

The company is using its portfolio of resources and infrastructure to gain competitive advantage in the rollout of renewable energy products, standing out in an increasingly competitive market, and exploring new investment opportunities in renewable energy sources.

Hybridization is a process in which different renewable generation technologies are combined to produce electricity more efficiently, using the strengths of one technology to complement another. That is one of the main priorities in this new plan. Around 60 projects are already planned in Europe, totaling about 1 GW.

Another strong component of this strategy is repowering (i.e., the modernization of the existing power generation system), which can increase the installed capacity and the longevity of current power plants. There are eight projects currently in the pipeline in Europe, representing around 70 MW. This comes in the wake of the successful Blue Canyon II repowering project, which saw a rise in installed capacity of around 10% and an increase in the wind farm’s expected lifespan of around 30 years.

Energy storage is another solution in which the company is set to further invest. An additional 0.5 GW in batterybased storage projects, largely co-located, are planned for 2023–26. About 33% of gross additions are also secured. The more mature North American market accounts for about 90%, with about 40 MW already under construction and a further 3 GW being developed, but EDP is exploring other markets to leverage its presence.

As for hydrogen, the goal is to reach a gross installed capacity of 1.5 GW by 2030, enabling the use of renewable energy sources to develop long-term options and leveraging partnerships as a mechanism for scalability.

- Leveraging existing grid connection capacity (e.g., solar to wind, solar to hydro, wind to hydro)

- ~1 GW in Europe (60 projects), including first Iberian hybrid site in operation

- Example: hybrid site of 70 MW floating solar, 70 MW of wind and 14 MW of solar utility scale

- Increasing installed capacity and park’s longevity

- ~70 MW in Europe(8 projects)

- Example: Blue Canyon II Wind Farm increased installed capacity by ~10% and park’s longevity extended ~30 years.

- +0.5 GW battery storage for 2023-26, mostly co-located

- ~33% of gross additions secured

- ~90% in North America(more mature market, 40 MW already under construction, 3GW pipeline)

- Exploring other markets, leveraging EDP’s presence

- Allowing for RES deployment and building long-term optionality

- 1.5 GW gross installed capacity by 2030

- Partnerships as a mechanism to scale up

- Competitive advantage through just transition projects in Iberia.

How will the solar distributed generation market grow?

Solar DG — where systems are installed near or within consumer sites, either on rooftops or on the ground, to generate electricity for local consumption — is a growing trend worldwide. It offers important environmental, economic, and energy security benefits. This segment is growing at around 40–50% globally, with about 80% of new additions happening in markets where EDP is already operating. The company aims to add 2.1 GWac by 2026, consolidating its foothold in a technology that will inevitably play a role in the future of the energy transition.

What are the growth prospects?

We anticipate a recurring EBITDA of €5.7 billion in 2026, with an average annual growth rate (AAGR) of 6% for 2022–2026, and a recurring net income of €1.4–1.5 billion in 2026, with an average annual growth rate of 12%–14% for 2022–2026. We also expect to maintain a strong balance sheet, supported by organic cash flow and asset rotation, reiterating our commitment to a BBB credit rating, with an FFO/net debt ratio of 21% in 2026.

edpON magazine

Read more on our magazine

edpON magazine is a premium, global, up-to-date publication to enhance the drive, talent and energy within EDP. An element of cohesion for the 13,000 employees worldwide, reinforcing our culture and purpose. And, at the same time, an amplifier of the company's achievements among the external public.

Take a behind-the-scenes tour of EDP Group's Capital Markets Day and business plan in our magazine!